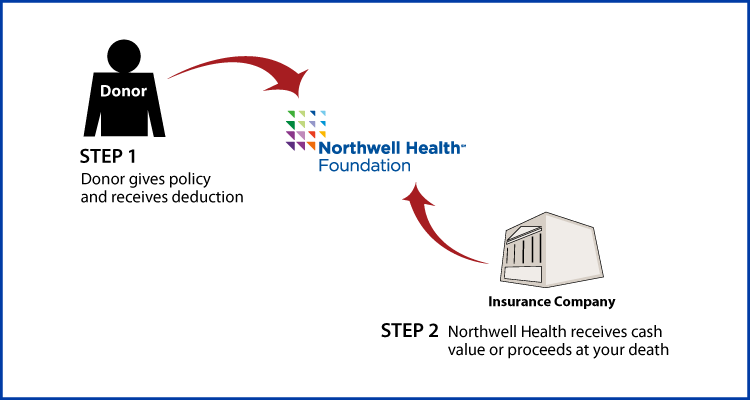

How It Works

- You assign all the rights in your insurance policy to Northwell Health, designate us as irrevocable beneficiary, and then receive an income-tax deduction

- Northwell Health may surrender the policy for its cash value or hold it and receive the proceeds at your death

Benefits

- You receive a federal income-tax deduction

- If premiums remain to be paid, you can receive income-tax deductions for contributions to Northwell Health to pay these premiums

- You can make a substantial gift on the installment plan

- Northwell Health receives a gift they can use now or hold for the future

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Alexandra P. Brovey, J.D., LL.M.

Senior Director, Gift Planning

Phone: (516) 321-6262

E-Mail: abrovey@northwell.edu

Hazel Paulino

Gift Planning Project Manager

Phone: (516) 321-6260

E-Mail: hpaulino@northwell.edu

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer